How to open a business bank account with Mercury - Globalfy's banking partner

As a Globalfy customer, you can easily apply for a Mercury bank account directly through the Globalfy Platform. To make this process even easier, we’ve prepared a step-by-step guide to help you apply:

💡 Tip: By depositing $5,000 into your Mercury account within the first 90 days, you’ll receive $125 cashback directly into your account!

Before you begin, have the following documents ready, as they will be required during the process:

- EIN letter.

- Your company's state registration document.

- The personal information of all the company members with more than 25% ownership. Including the passport for each member.

-

You’ll also need to provide proof of a physical address to use as your company’s business address. This address can be located either in the U.S. or in your country of residence. To verify it, you can submit documents such as a utility bill (water, electricity, internet), a bank statement in the name of the company or one of its members, or other accepted documents listed here.

Now let’s begin with the application.

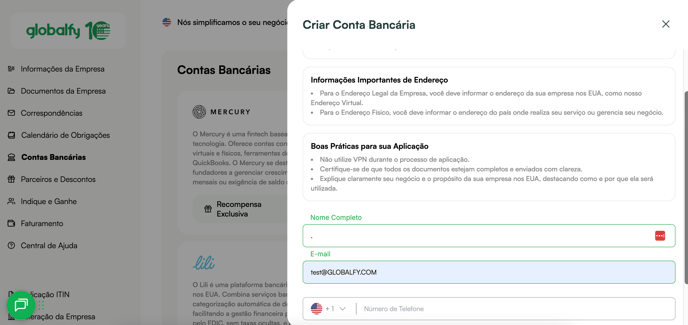

1) Go to Globalfy's Platform, click on "Bank Accounts" and choose Mercury. Enter your name, email and phone number:

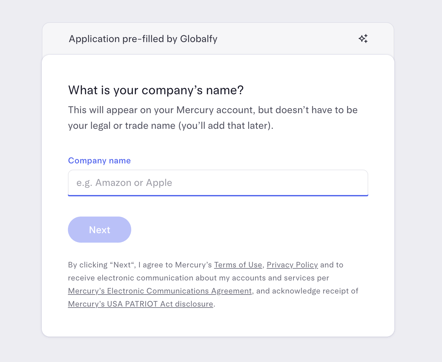

After that, add the name of your company: Ex: Company Name, LLC.

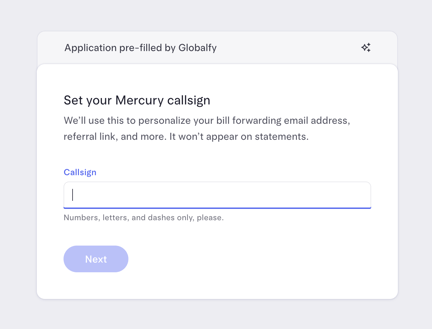

Moving forward, you will need to enter a call sign*.

*The callsign will be the website address of your bank account (URL), which can be modified as you please. This call sign must be written correctly without spaces, all in lowercase, and without special characters. And if your call sign is already taken, you will get an alert indicating to enter a new name for it.

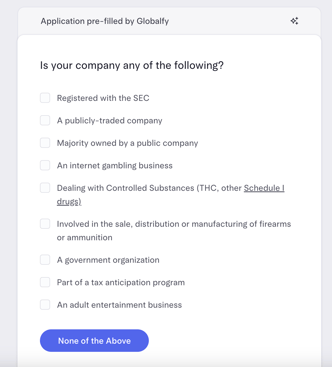

Then you will need to confirm if your business falls into one of the following categories that you must select according to the activity of your company:

*If your company is not involved with any of the categories, you can click on the blue button “None of the above”.

Then you will start the 6 steps of the application

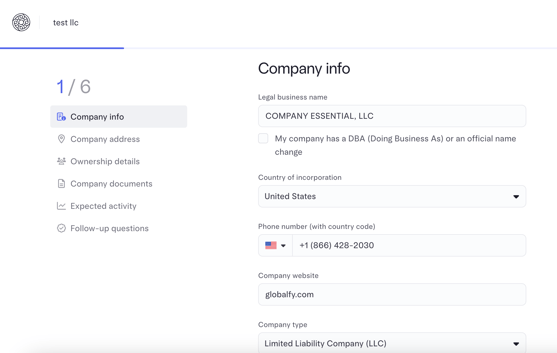

1st step

Here you must fill, the legal business name of your company, and confirm if it has a doing business as.

To know better what a “doing business as” is, kindly refer yourself to this article of our blog if you don’t have a DBA you can skip this step.

- Country of incorporation will be the United States.

- In phone number, you must enter a number where the bank can call you if necessary. It can be either an US number or a number from your country. The important thing here is that the bank can get in touch with you easily at that number.

- In “Employer identification number” you enter your EIN number. If you don’t remember the number or don’t have the document, you can get in touch with our customer support here, and we will provide the document to you.

- In “Company website” you can enter your company website, but if you don’t have one yet, you can skip this step since it is optional.

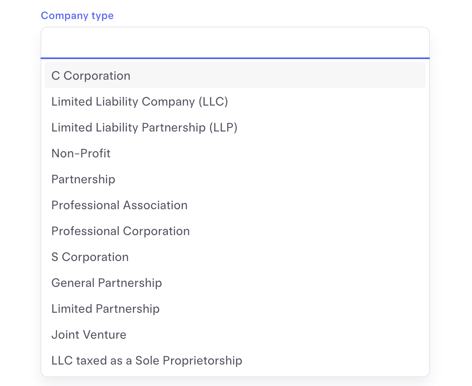

In “Company type” you can select the structure of your company, that can be one of the following:

If you are unsure of your company’s structure, you can get in touch with our customer support team here, and we will assist you with this question.

- In “Industry” please select the category that better describes the operation of your company.

- In “Tell us about what your company does” please share a brief but complete description of the activities that your company does. This description must be done in English.

- In “Major Investors” if you have any US major investor please select the category, if you don’t please skip this option.

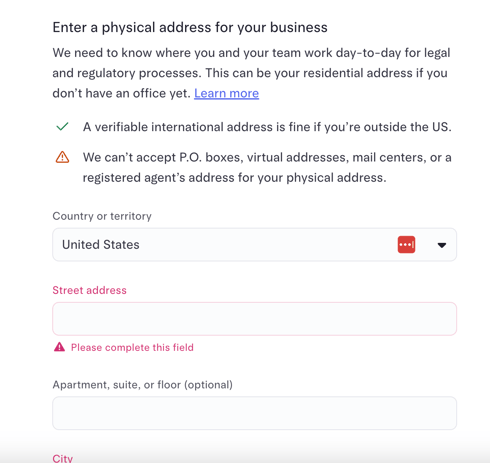

2nd step

In “Company address” you must enter your registered agent address.

After that, in the Physical Address field, enter the physical address from where you operate your company.

This address can be outside the United States — it can even be your residential address if you work from home.

(Remember that later, the system will request a proof of address for the location you provided.)

3rd step

Ownership Details: Here, you must enter the details of any member in your company with at least a 25% of ownership

*Take into consideration that you must carry out a Security identification process for each member that you add with more than 25% of ownership. This will consist of taking a photo of each member’s face and a photo of each member’s passport. Please make sure that you have all this information when applying.

To add more members, you need to click on “Add another owner profile” after filling out all the information of the prior member and follow the same steps as before.

And then click on Next to move on with the application.

4th step

In “Company documents” you must upload your company documents such as:

- EIN letter.

- Certificate of formation/Articles of organization. (This is the state registration document).

If you don’t have your company formation documents, please feel free to contact our customer support team here and request for these documents.

5th step

Here indicate the expected activity in the Mercury account.

In the field “Where will your first deposits come from?”, select “Self” if the first deposits will come from your personal account.

Next, the system will request proof of the source of funds, and you can upload a statement from your personal account as evidence. It doesn’t need to be a U.S. account.

**If the system isn’t letting you move forward, it is because something is missing in the application. An alert icon will appear if this is the case, so you will need to go back to the step that is missing and complete the needed information.

Revision timeframe: After submitting the application, the Mercury normally takes between 3-4 business days to review your documents and give you an answer by email, so it is important to be attentive to your email during this time.

**Note: It is not necessary to connect your account to the Mercury if the system requests it. You can just disregard that message since this process won’t interfere with the application’s decision in the bank.

Also, if any document was not correctly uploaded or if the Mercury requires more details of your business, they will also get in touch with you by email requesting this information.

After the bank’s review, you will receive an email with the results of the application. If approved, you will have access to your bank account immediately, and you can access using your email address and password previously set up.

For any queries during this process, check out the Mercury FAQ section for detailed answers to common questions. Mercury offers various banking features for startups, including FDIC-insured accounts up to $5 million, ensuring your funds are safe and secure.

![]()

If you still have any questions or need further assistance regarding this topic, we are available to assist you. Simply click here to submit your support request and our team will assist you.