How to open a business bank account with Mercury - Globalfy's banking partner?

As a Globalfy customer, you can easily apply for a Mercury bank account directly through our Platform. To make this process even easier, we’ve prepared a step-by-step guide to help you apply.

💡 Tip: By depositing $5,000 into your Mercury account within the first 90 days, you’ll receive $125 cashback directly into your account!

Required Documents Before You Begin

To streamline the application process, make sure you have the following documents and information ready:

-

EIN confirmation letter.

-

Company’s state registration document.

-

Personal details of all company members holding more than 25% ownership, including a valid passport for each member.

-

Proof of business address: This can be located either in the U.S. or in your country of residence. Acceptable documents for verification include:

-

Utility bill (water, electricity, internet).

-

Bank statement in the name of the company or one of its members.

-

Other approved documents listed in Mercury’s guidelines.

-

Starting the Application

Access the Platform

-

Go to the Platform.

-

Click on “Bank Accounts” and select Mercury.

-

Enter your name, email, and phone number.

Add Your Company Information

-

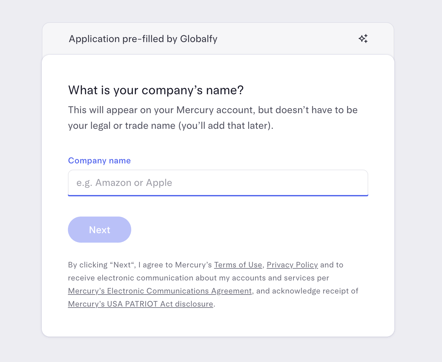

Enter the legal name of your company (e.g., Company Name, LLC).

Create a Call Sign

-

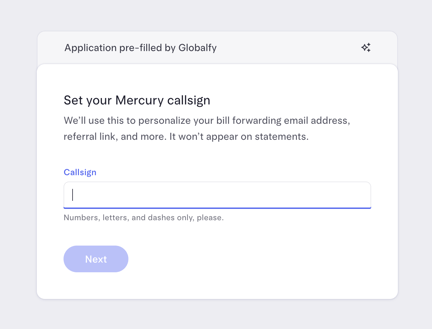

You will be asked to create a call sign.

Note: The call sign will serve as the URL for your bank account.

-

Must be written in lowercase, without spaces or special characters.

-

If the chosen call sign is already taken, you’ll receive an alert and need to select a new one.

-

You can modify it later if needed.

Confirm Your Business Category

-

Indicate whether your company falls into one of the listed categories.

If your company does not belong to any of the categories, simply click the blue button “None of the above.”

Begin the Application Process

-

Once these steps are complete, you’ll proceed to the six stages of the Mercury application.

Step 1: Company Information

-

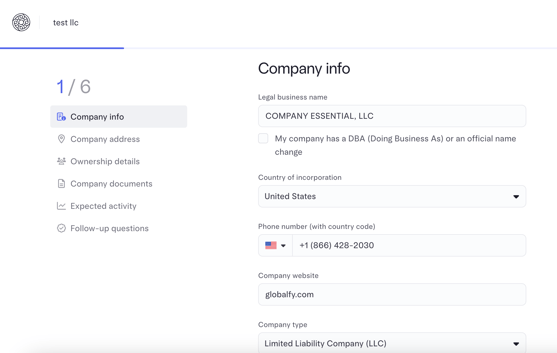

Enter your legal business name and confirm if your company has a “Doing Business As” (DBA) name.

-

If you’re unsure what a DBA is, refer to our blog article. If you don’t have one, you can skip this step.

-

-

Country of incorporation: Select United States.

-

Phone number: Provide a number where the bank can easily reach you. It can be either a U.S. number or one from your country of residence.

-

Employer Identification Number (EIN): Enter your EIN. If you don’t remember it or don’t have the document, contact our customer support team for assistance.

-

Company website: Optional. If you don’t have one yet, you may skip this field.

-

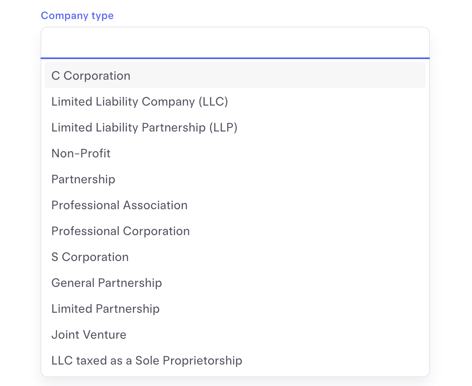

Company type: Select your company’s legal structure from the available options.

-

Industry: Choose the category that best describes your company’s operations.

-

Business description: Provide a brief but complete description of your company’s activities (in English).

-

Major investors: If you have U.S. major investors, select the appropriate category. If not, skip this field.

If you’re unsure, reach out to our customer experience team for guidance.

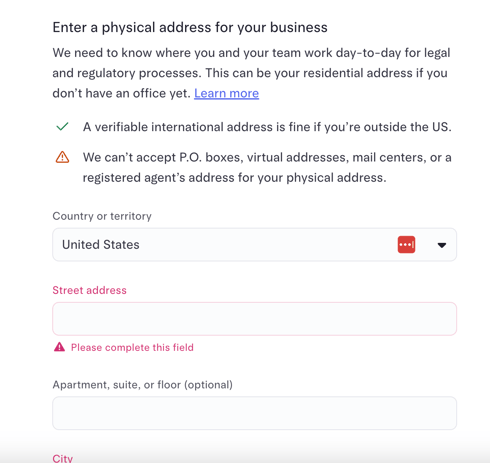

Step 2: Company Address

-

In Company Address, you must enter your company’s registered agent address.

-

In Physical address, enter the physical location where your company operates.

-

This can be outside the U.S. and may even be your residential address if you work from home.

-

-

Later, you’ll be asked to upload proof of address for verification.

Step 3: Ownership Details

-

Provide details for each company member holding 25% or more ownership.

-

Complete the security identification process for each member:

-

Take and upload a photo of the member’s face.

-

Upload a photo of the member’s passport.

-

-

To add multiple owners, click “Add another owner profile” and repeat the process.

-

Once all owners are added, click Next to continue.

Step 4: Company Documents

Upload the following documents:

-

EIN confirmation letter

-

Certificate of Formation / Articles of Organization (state registration document).

You can find these documents in the Company Documents section of the Globalfy's Platform. If they are not available there, please contact our customer experience team to request them.

Step 5: Account Activity

-

Indicate the expected activity in your Mercury account.

-

In “Where will your first deposits come from?”, select “Self” if deposits will come from your personal account.

-

Upload a bank statement from your personal account as proof of funds.

-

This does not need to be a U.S. account.

-

⚠️ If the system prevents you from moving forward, check for missing information. An alert icon will indicate which step needs to be completed – Go back to the step that is missing and complete the required information.

Review and Approval

-

Processing time: Mercury typically reviews applications within 3–4 business days. You’ll receive an email with the results.

No need to connect your account: If prompted to connect your account to Mercury, you can ignore this step—it won’t affect the bank’s decision.

-

If documents are incomplete or additional details are required, Mercury will contact you by email.

-

Once approved, you’ll gain immediate access to your account using the email and password you set up.

Additional Notes

-

For questions during the process, consult the Mercury FAQ section.

-

Mercury offers banking features tailored for startups, including FDIC‑insured accounts up to $5 million, ensuring your funds are secure.

- To learn more about the benefits of opening a Mercury account, please refer to this article for detailed insights and advantages.

![]()